Boost Your Credit and Secure $100k+ in Business Funding to Build or Scale Your E-Commerce Brand

We’ve helped people just like you fix their credit, secure business funding, and finally grow their stores. Book a free call to see how we can help you.

Want to Unlock $100k+ in Business Funding? Let’s Build Your Credit and Get You Started—Book a Free Call!

See How We Helped Business Owners Boost Their Credit and Secure $100k+ in Funding

"Truly Blessed"

Alumni Creative helped me boost my credit score by 100 points and secure $30k in business funding. I was finally able to invest in the inventory and marketing I needed to grow my store.

- Diana Thomas

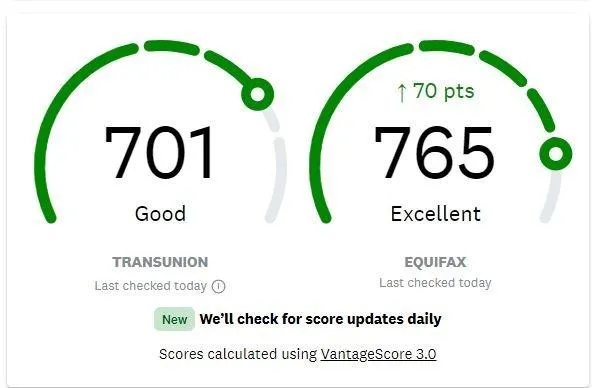

"Highly recommend this"

With the team’s guidance, I improved my credit and secured $120k in funding, which allowed me to launch my e-commerce business and hit my first $50k month

- Dixon L., Startup Founder.

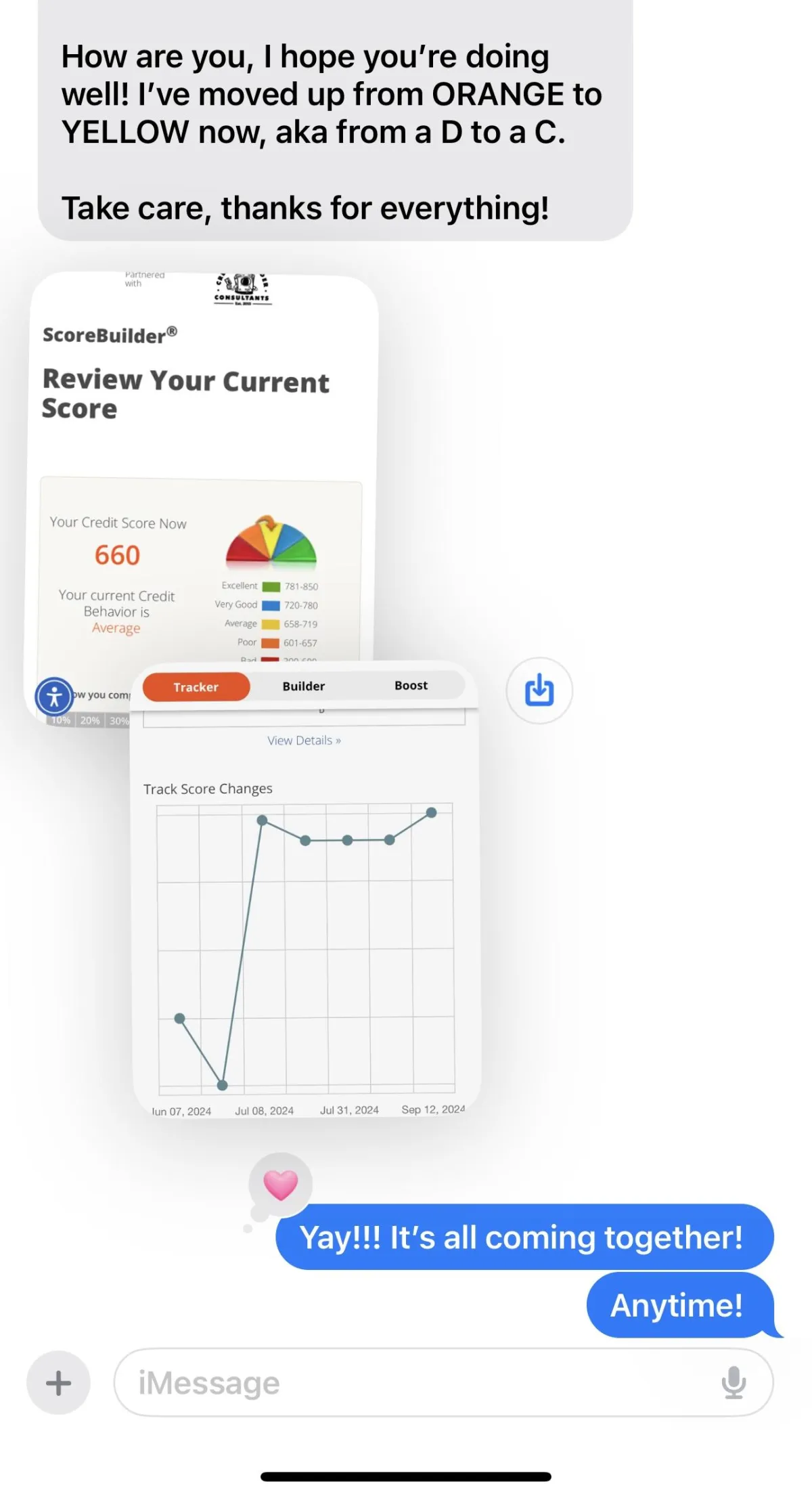

"Ralph & Jay are the best to do it!"

Contacted Jay a few months ago needing his credit repair services. Fast forward 3 months later I am at 765! Now time to get FUNDED!

- Greg J., Infiniteform Inc.

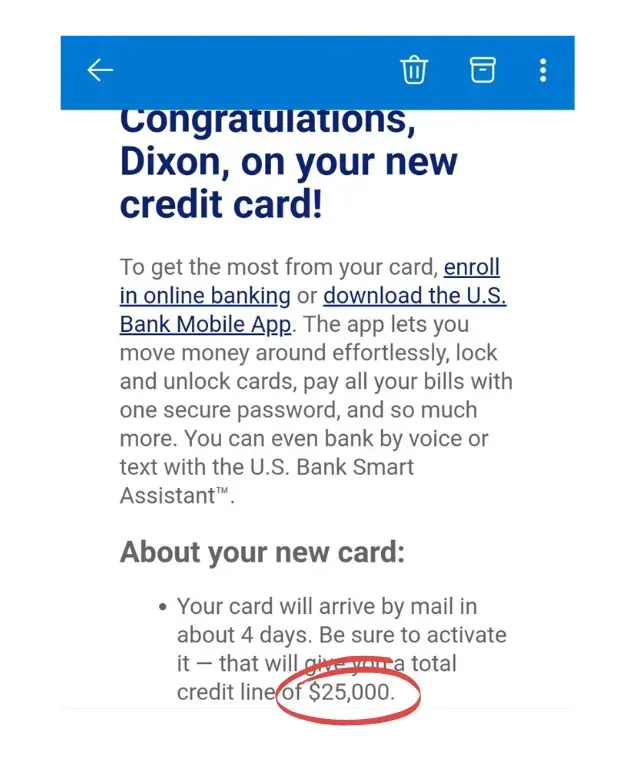

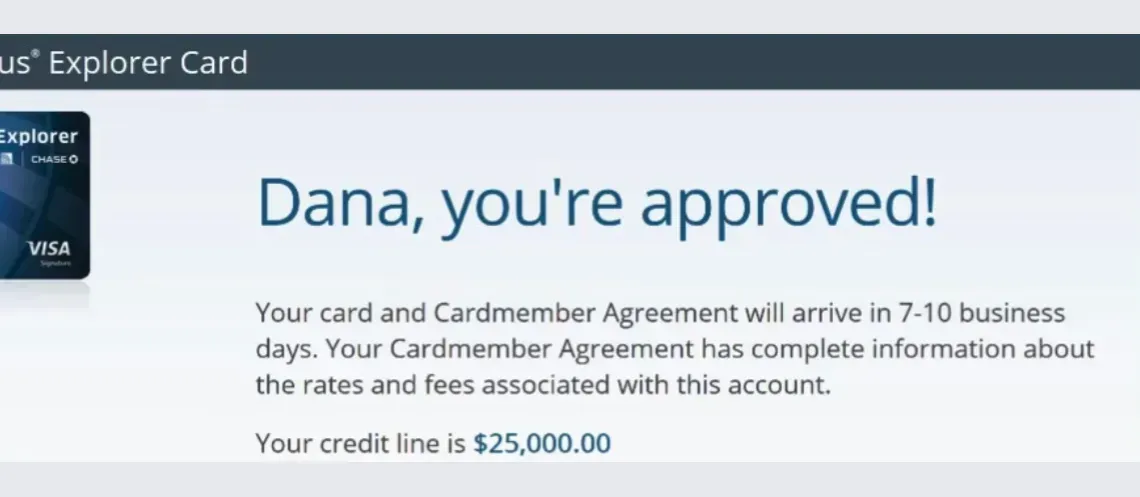

"$25k approved!!!"

It's crazy how the team at Alumni Creative was able to turn my credit upside down and help me lock in $25k before the year is over.

- Dana M., Fashion Boutique

Trusted By 5,247+ Business Owners & Entrepreneurs

What You’ll Get When You Work With Us

We provide everything you need to repair your credit, secure business funding, and build a successful e-commerce brand. Here’s what’s included when you partner with us:

Comprehensive Credit Repair Program

Personalized Credit Audit

Step-by-Step Credit Repair Plan

Access to Dispute Templates

Ongoing Credit Monitoring

Access to the DIY Credit Repair Ebook!

Business Funding Solutions

Up to $100k+ in Business Funding

0% Interest Funding Options

Funding Application Assistance

Connections to Trusted Lenders

Access to the Business Funding EBook!

Ongoing Support and Consultation

One-on-One Coaching Sessions

24/7 Email Support

Quarterly Business Review

Discounts on Future Services

Lifetime Access to Updated Guides

Not Ready for a Call Yet? Start With Our $27 Credit Repair and Business Funding Ebook!

Our comprehensive ebooks gives you the exact steps and resources to start repairing your credit and securing funding, so you can begin building your e-commerce brand today.

DIY Credit Repair Guide: Learn proven strategies to boost your credit score on your own with our step-by-step instructions.

Funding Resources and Tips: Discover how to access up to $100k+ in business funding, even if you’re starting from scratch.

Dispute Templates Included: Get pre-made templates to help remove inaccurate or negative items from your credit report effectively.

Lifetime Access to Updates: As we update the ebook with new resources and strategies, you’ll receive all updates at no extra cost.

Access to the Business Funding Playbook!

BOOK A CALL WITH US TODAY!

READY TO SCALE YOUR BRAND?

Here's how it works

Easy 3 Step Process

Schedule a time that works for you so we can discuss your goals and challenges.

On the call, we’ll review your situation and create a tailored plan to boost your credit and secure the funds you need.

We’ll guide you step-by-step, providing all the resources needed to help you grow your business.

Still not sure?

Frequently Asked Questions

What’s the cost of the consultation?

The initial consultation is completely free. During this call, we’ll assess your credit and funding needs and provide a customized plan. We only move forward with clients if we’re confident we can help you achieve your goals.

How long does it take to secure funding?

It depends on your current credit status and financial situation. However, many clients secure funding within 30-60 days after working with us. We tailor the process to your specific needs to ensure you receive funding as quickly as possible.

Can I still qualify for funding if I have bad credit?

Yes, even if you have poor credit, we have strategies and partners that specialize in helping clients improve their credit and access funding. Our credit repair program is designed to boost your score and increase your chances of approval.

Is this a legitimate service?

Absolutely. We’ve helped dozens of clients, like Justin, boost their credit scores and secure business funding. Our process is transparent, and we work with reputable lenders to ensure you receive the best possible options. You can read more about our success stories above.

How much funding can I realistically expect to receive?

The amount of funding you can receive depends on your credit profile and financial history. On average, our clients secure between $50k and $150k in business funding. During the consultation, we’ll give you a realistic estimate based on your current situation.

Are there any hidden fees or commitments?

No, there are no hidden fees. Our initial consultation is free, and we only proceed with services if you decide to move forward with our recommendations. Everything is transparent, and you’ll know the costs upfront before making any decisions.

What if I don’t qualify for funding right away?

If you don’t qualify immediately, don’t worry—we have a credit improvement program designed to help you boost your score and become eligible for funding. We’ll work with you step-by-step until you reach the necessary requirements.

How does the credit repair process work?

We start with a full credit audit to identify areas for improvement. We then create a personalized action plan, which includes dispute letters and other strategies to help remove negative items and improve your score. You’ll also have ongoing credit monitoring to track your progress.

Will applying for business funding affect my credit score?

We work with lenders who conduct soft credit inquiries initially, which won’t impact your credit score. When you decide to move forward with funding options, any impact will be minimal, and our team will guide you on how to mitigate it.

What type of businesses do you work with?

We specialize in helping e-commerce business owners, startup entrepreneurs, and small businesses looking to scale. Whether you’re launching a new venture or expanding an existing one, we have the resources to help you secure the funding and support you need.

How long will the credit repair process take?

Credit repair timelines vary depending on the individual situation, but most clients see significant improvements in 3-6 months. We monitor progress and adjust strategies as needed to accelerate results.

What makes you different from other credit repair or business funding companies?

Unlike other services that charge upfront fees or overpromise results, we focus on building a realistic, tailored plan for each client. We’ve worked with a range of businesses, providing proven strategies that have helped our clients achieve their financial goals.

Innovation

Fresh, creative solutions.

Integrity

Honesty and transparency.

Excellence

Top-notch services.